Margin trading

Overview of Margin Trading

- Margin trading is a form of borrowing money from a securities company to buy securities. Margin trading creates good opportunities, increases investment efficiency but also has many potential risks. Carefully learning about margin trading is extremely important to gain good profits and avoid risks.

- Margin trading is essentially using leverage in securities investment activities. It is easy to understand that if your investment activities are effective, the profit from the investment can increase many times compared to using only your own capital.

- Each type of business has certain advantages and disadvantages. Investors need to carefully research market trends, their own capabilities, investment methods, and stocks being invested in to make appropriate decisions. The advice is that if the market trend is determined to be an upward trend, investors can increase the yield from margin buying activities.

How and instructions for performing Margin Trading

1. Loan Limit

- Not exceeding 3% of NVS’s equity according to the latest audited financial statements.

- The Customer can disburse multiple times but the total outstanding loan balance (including principal and interest) at any time must not exceed the Loan Limit. For any reason, if the Customer’s total outstanding loan balance exceeds the Loan Limit, the Customer must pay the excess amount on the same day.

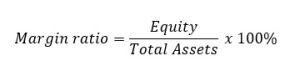

2. Margin ratio

- In which:

- Equity = Total Assets – Margin Debt

- Margin Debt = Total principal and interest of Loans.

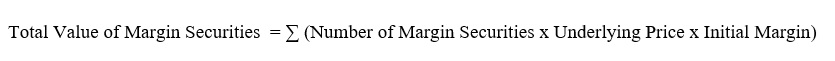

- Total Assets = Cash + Proceeds from selling securities awaiting to be returned + Total Value of Margin Securities currently available and/or awaiting to be returned on the Trading Account.

-

- Initial margin: 50%

- Safe margin: 40%

- Warning margin: 35%

- Processing Margin: 30%

3. Loan Terms

- Margin loan interest rate: 0.04%/day

- Overdue interest: 150% of the interest within the term.

- Margin loan term and contract extension conditions:

- Maximum of 90 (ninety) days from the date NVS disburses the Loan

- Loan Term can be extended up to 90 (ninety) days.

- Loan Interest Rate calculation start date: The date NVS disburses the Loan.

- Loan Interest Rate: 0.04%/day. Minimum loan interest is 50,000 (fifty thousand) VND.

- Overdue interest rate is equal to 150% of the Loan Interest Rate.

4. Method of executing additional margin call

Step 1

Upon receipt of a margin call, the client must provide additional collateral to at least maintain the maintenance margin ratio. Additional collateral is provided in the following forms:

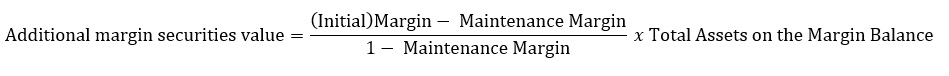

- Additional collateral by securities, the value of additional collateral securities is calculated according to the following formula:

- In case of additional funds, the additional amount is determined according to the following formula:

Additional Funds = | (Initial) Margin – Maintenance Margin | x Total Assets on the Margin Balance

Step 2

- The securities company has the option to sell mortgaged securities on the customer’s margin trading account when the customer does not supplement or does not fully supplement the mortgaged assets within the time limit according to the additional margin call.

- In case the customer does not add or only adds a part of the collateral, depending on whether the value of the remaining collateral to be added is less than or greater than the total value of the securities in the margin trading account, the securities company is allowed to sell a part or all of the collateral securities;

- Before executing an order to sell mortgaged securities, the securities company is responsible for notifying the customer and after the sale, the securities company is responsible for sending the customer a statement of the results of the mortgaged securities sale transaction in a manner agreed upon in writing between the securities company and the customer.

- In case a securities company sells all securities in the margin trading account at the request of a customer or when making an additional margin call, the customer may only withdraw the remaining amount (if any) from the proceeds of the sale of securities in the margin trading account after deducting the margin balance.

- In case the total assets in the customer’s margin trading account after selling mortgaged securities are not enough to cover the margin debt and the customer fails to pay the remaining debt as agreed in the Margin Trading Account Opening Contract, the securities company shall collect the debt according to the method agreed in the Margin Trading Account Opening Contract and in accordance with the law.

Fees

-

- Price list of securities services at Navibank Securities Joint Stock Company (applied from January 1st, 2024)

See more detail here.

List of securities for margin trading by NVS

| Margin directory | Time | Download |

| List of securities performing margin trading in the third quarter of 2024 | 08/07/2024 | |

| List of securities for margin trading in Jun 2024 | 05/07/2024 | |

| List of securities for margin trading in May 2024 | 06/06/2024 | |

| List of securities for margin trading in April 2024 | 06/05/2024 | |

| List of securities performing margin trading in the second quarter of 2024 | 11/04/2024 | |

| List of securities for margin trading in March 2024 | 04/03/2024 | |

| List of securities to carry out margin trading in February 2024 | 04/02/2024 | |

| List of securities for margin trading in January 2024 | 04/01/2024 |

Frequently asked questions

Customers can go directly to Navibank Securities Joint Stock Company to receive advice and support for implementing this service.

To use NVS’s Margin Trading service, customers need to meet the following conditions:

- Have a Securities Account at NVS

- Sign and open the Margin Trading Contract according to NVS’s Form

- Accept the risks related to

You cannot do this.

To buy upcom stocks and stocks on the banned list of the Stock Exchange, please transfer money internally from the margin trading sub-account to the regular sub-account (the sub-account does not use borrowed money from the securities company).

- The overdue interest rate of a margin loan is: 150% of the loan interest rate within the term

- Loan term: 90 days

- Loan limit for a customer: Depends on the period announced by NVS

When registering to use this product, you will not be charged any registration fee for using the service. Only when a loan arises will the loan fee be charged.